These averages may not be accurate for your particular situation. PMI, property taxes and homeowners insurance (aka hazard insurance OR home insurance) are defaulted to national averages in the US.The actual PMI is based on your loan-to-value (LTV), credit score and debt-to-income (DTI) ratio.

EXTRA PAYMENT MORTGAGE CALCULATOR WITH AMORTIZATION FREE

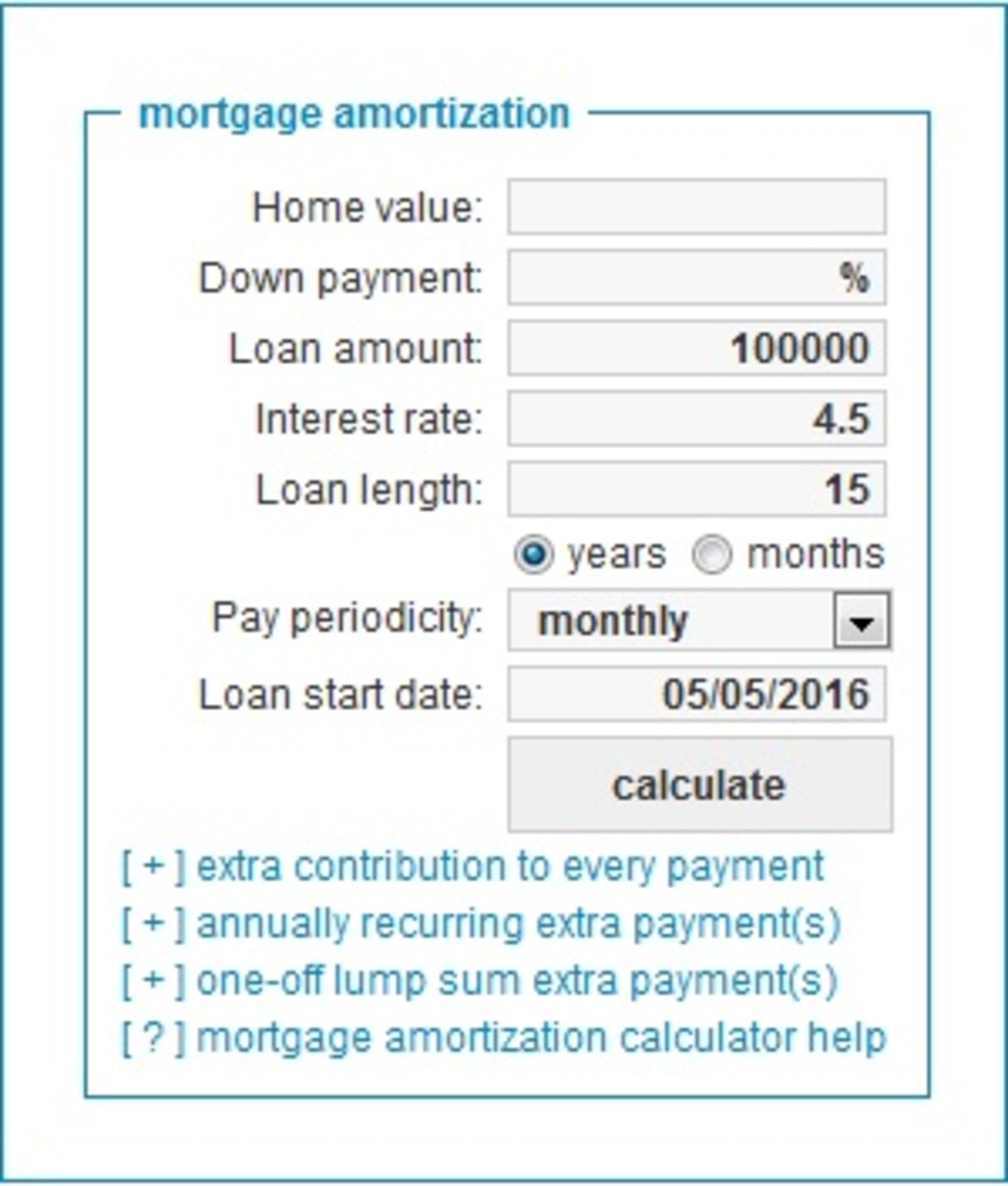

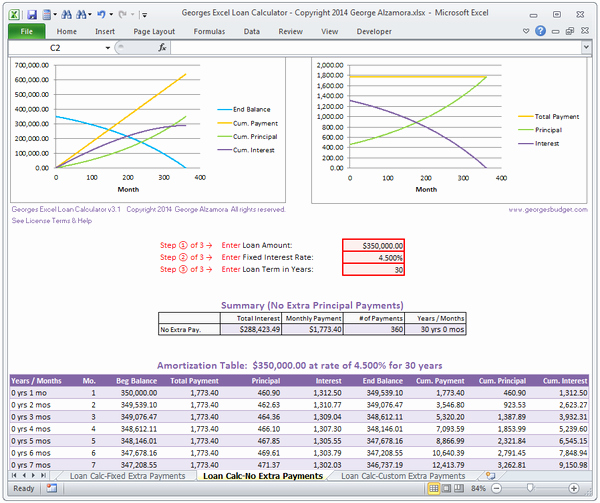

Try different options and combinations of regular or non-regular extra payments and find out how and when you can pay off your mortgage.This free mortgage calculator helps you estimate your monthly payment with the principal and interest components, property taxes, PMI, homeowner’s insurance and HOA fees. This great and easy to use online tool can help you determine the amount and frequency of your extra monthly payments and help you analyze all possibilities you have. Mortgage extra payment calculator can be used to build your personal extra payment amortization schedule for different payment frequencies. The mortgage calculator with extra payments is a simple online tool that can help you make the right financial decision for your situation and pay off your loan sooner. The Online Mortgage Calculator with Extra Payments and Amortization Schedule Is a Great Tool That Is Easy to Use! You can save hundreds of dollars in interest that way, so do not hesitate, but try to calculate your extra payment options and your interest savings now!įor each payment extra payments – examples Loan information Every extra payment towards principal you made would shorten the loan term and reduce the total interest on your mortgage. The fact is that the majority of your mortgage monthly payment in the first years of the loan will be spent for interest payment and have almost no impact towards the principal of the loan.Įxtra payments can help you change that, make your loan cheaper and repay it early. With mortgage calculator with extra payments, you can calculate the amount of money you can save by adding some extra payments to your required mortgage scheme. How much interest can you save on voluntary extra mortgage payments? The most important one is a positive impact on your interest savings, which means that in total you would pay less money for your loan. Reduce the Total Interest Payment and Save Your MoneyĮxtra payment printable amortization schedule has many benefits.

One-time yearly extra payments – examples Loan information Mortgage calculator with extra payments can help you review your options, so you would make a great extra payment amortization schedule that will shorten your original mortgage term for few months or even years. It is not necessary that your extra payments are large because every added dollar counts and can help you reach your goal faster. Every additional payment to required mortgage payment scheme is a step towards a life without debt.Īmortization with extra payments can give you financial freedom much sooner, so it is smart to reconsider this option and learn how quickly you may be able to repay your mortgage. You can make one-time, one-time yearly or for each payment extra payments towards the principal and therefore shorten original mortgage term. One-time extra payments $40,000.00 – examples Loan informationĪdding Extra Payments Would Shorten Original Mortgage TermĮxtra payment amortization schedule can certainly help you get out of your debt faster.

0 kommentar(er)

0 kommentar(er)